A billion dollars were "buried": DGF refused to return stolen funds of Delta Bank to Ukraine?

© Photo: stopcor.org

Did the state, represented by the Deposit Guarantee Fund, give up the fight for Ukrainians' money and actually bury the case of Delta Bank, which had every chance of becoming a successful case?

Ukraine is losing a billion dollars: the funds stolen and transferred abroad by Lagun, the owner of Delta Bank, could have been returned to the budget, but were not because of "underhanded games." The Deposit Guarantee Fund actually failed a tender for asset tracing, refusing to allow a well-known law firm to participate. Is this negligence or deliberate sabotage?

In order to understand the situation, the StopCor team thoroughly investigated the course of this story and took a detailed comment from Valentyn Zagariy, Managing Partner of Spence Law Firm. But first, let's recall the details of one of the most high-profile banking scams in Ukraine.

What happened to the funds of Delta Bank depositors?

In October 2014, JSC Delta Bank, which at that time was one of the top 5 banks in Ukraine in terms of assets, was suddenly classified as a problem bank, and in March 2015 it was declared insolvent (NBU Resolution No. 150 of 02.03.2015).

In early October 2015, the National Bank of Ukraine, on the proposal of the Deposit Guarantee Fund, decided to revoke the banking license and liquidate PJSC Delta Bank. The reason for this was the unsatisfactory condition of the bank's assets.

"Delta Bank was established by millionaire Nikolai Lagun in 2006 - according to Forbes, in the image and likeness of Rustam Tariko's Russian Standard. To launch his brainchild, the young banker borrowed $100 million from Victor Pinchuk, and in 2009 Delta, with the assistance of then-NBU Governor Arbuzov, bought out Kreditprombank, which belonged to the Donetsk-based bank.

In late 2013, amid the Revolution of Dignity, when depositors began to withdraw funds from banks en masse and borrowers began to delay loan repayments, Delta Bank was one of the first financial institutions to apply for refinancing from the National Bank. Between December 2013 and September 2014, Laguna Bank received more than UAH 10 billion.

As the Prosecutor General's Office later found out, Delta Bank converted UAH 4.1 billion of the "refinancing" and sent more than half a billion dollars to foreign accounts of 12 related companies. Another $253 million was written off from the bank's correspondent accounts with foreign Bank Winter, Meinl Bank, and Bank Frick.

In total, the fall of Delta gave rise to 600 criminal cases, and Lagun was suspected of embezzling more than UAH 1 billion in 2021. However, none of these cases has resulted in anything concrete so far.

Is it possible to recover this billion and return the depositors' funds to Ukraine?

In November 2019, the Deposit Guarantee Fund announced a tender for the search and pre-trial actions to recover the funds of Delta Bank transferred abroad in accordance with Article 52 of the Law on the Deposit Guarantee Fund.

According to this document, the DGF's claims for compensation for damage (losses) caused to the bank may be secured by seizing movable and immovable property of persons related to the bank whose actions caused damage (losses) to the bank

"This article allows for the recovery of losses caused by the liquidation of a bank. And the state, represented by the Deposit Guarantee Fund, can collect these funds. All large banks have been moved abroad by 90%. The scheme: Back-to-back loans, when foreign banks (such as Bank Winter, Meinl Bank and Bank Frick) received loans for "zero" offshore companies secured by funds held on correspondent accounts of Ukrainian banks. The amount of collateral reached hundreds of millions of dollars. Accordingly, the offshore companies did not repay the loans, and foreign banks collected hundreds of millions of dollars from the correspondent accounts of Ukrainian banks in their favor. In particular, Delta Bank. In a strange way, the beneficiaries of these offshore companies were familiar owners of Ukrainian banks, including Delta Bank. Not only we have the specific names of the companies and the amounts, the investigation has them as well," explains Valentyn Zagariya, lawyer, managing partner of Spence Law Firm.

Spencers Law Firm is one of the participants in the tender announced by the DGF to help the state recover funds from Delta Bank.

How did the tender go?

A total of six participants applied for the tender, but after the qualification stage, two Ukrainian companies were eliminated. Four law firms remained in the game: Spence, GATELEY Plc, DWF LAW and Rosling King (RK). The next stage, the presentation of search strategies, took place on January 14, 2020. Olena Nuzhnenko, Deputy Head of the DGF, was responsible for this stage.

"Tracing assets abroad is a standard, rather expensive procedure that costs between 60 and 100 thousand US dollars. We brought scouts (representatives of an international contractor specializing in asset tracing abroad - ed.) They prepared a structure of Lagun's assets, indicating where he has real estate and details of foreign companies related to him, involved in the withdrawal of funds abroad. Our English solicitor said that it would take him six weeks to get a Worldwide Freezing Order against Lagun, as 90% of the work has been done - all the necessary materials are already available. The next step is the court in the UK and the seizure of assets. We have already received positive feedback from the commission," says Zagariya.

However, in the end, Spensers Law Firm was denied access to the next stage - submission of commercial proposals. Interestingly, Spensers was the only bidder that did not demand money from the state in its commercial proposal and was ready to finance the work of the intelligence officers at its own expense. However, according to Zagariya, this was the real reason for the company's refusal to proceed to the final stage.

Who won the tender?

As a result of the tender, the Deposit Guarantee Fund signed an agreement with the British law firm DWF LAW. In a press release, the DGF noted that "during the tender, there were cases when some bidders ignored the existence of a conflict of interest." The winner of the tender was described by the Fund as a company "with a strong infrastructure and developed litigation practice, with many years of experience in successfully supporting complex cross-border disputes and asset tracing".

At the same time, there is information in open sources about DWF LAW's cooperation with a Ukrainian company, which may indicate a possible conflict of interest. This is Intergrits, which represented the interests of the plaintiff against the DGF in one of the lawsuits.

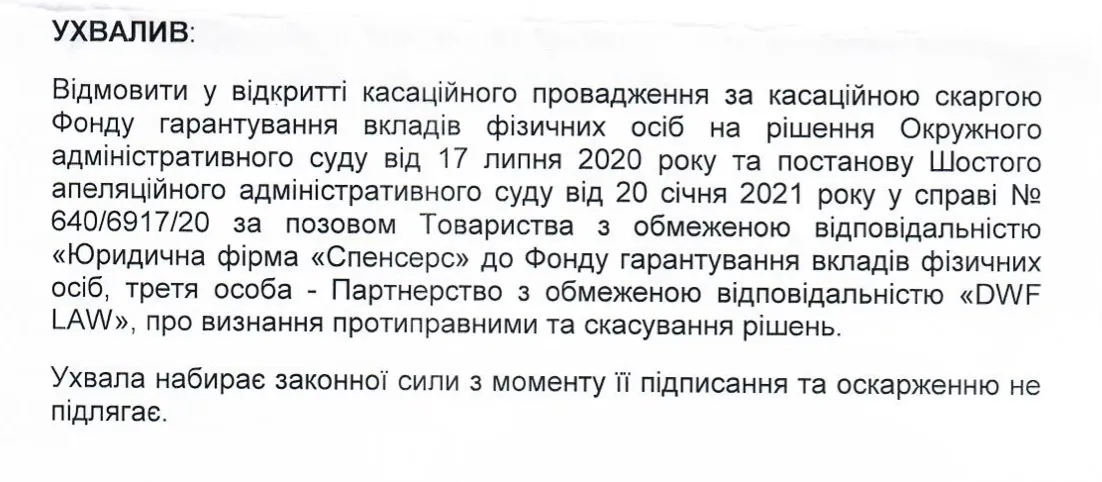

In turn, Spensers Law Firm appealed its non-admission to the final stage of the tender. By the decision of the Kyiv District Administrative Court in case No. 640/6917/19 dated 17.07.2020, upheld by the decisions of the Sixth Administrative Court of Appeal dated 20.01.2021 and 13.12. 2021 unchanged, the claims of Spencers Law Firm LLC to the Deposit Guarantee Fund with the participation of a third party without independent claims on the subject of the dispute on the side of the defendant DWF LAW Limited Liability Partnership to declare unlawful and cancel the decision of the Deposit Guarantee Fund, formalized by the minutes of the tender committee of the Deposit Guarantee Fund dated February 05, 2020 No. 063/20 regarding the non-admission of Spence Law Firm LLC to the third stage of the tender for the purchase of legal services, and the invalidation and cancellation of the decision of the Deposit Guarantee Fund dated March 02, 2020 No. 118/20, are fully satisfied.

At the same time, Spencers Law Firm filed a lawsuit with the Kyiv Commercial Court against the Deposit Guarantee Fund and DWF LAW Limited Liability Partnership to invalidate the agreement dated 10.04.2020 concluded between the Deposit Guarantee Fund and DWF LAW Limited Liability Partnership based on the results of a tender for the procurement of services to represent the interests of the DGF and/or Delta Bank JSC in litigation in foreign jurisdictions.

By the decision of the Commercial Court of Kyiv in case No. 910/14064/20 dated 12/23/2021, which entered into force, Spence Law Firm's claims were fully satisfied. The agreement dated 10.04.2020 concluded between the Deposit Guarantee Fund and DWF LAW Limited Liability Partnership based on the results of the Tender for the procurement of services for representation of the interests of the DGF and/or Delta Bank JSC in foreign jurisdictions was invalidated.

On September 20, 2022, the Northern Commercial Court of Appeal refused to satisfy the DGF's appeal and upheld the court's decision.

"We have received a positive decision from the District Administrative Court and a decision from the Supreme Court, which states that the Deposit Guarantee Fund illegally deprived Spensers of the right to participate in the final stage of the competition. The court ruled that the selection of the winner was illegal. "We tried to resume the tender, as 30-50% of the amount withdrawn from Delta Bank abroad can still be returned. We sent a corresponding request to the Fund," says Valentyn Zagariya.

However, according to him, the DGF refused to meet his request: the head of the Fund, Svitlana Rekrut, allegedly explained that the fact that the results of the previous tender were canceled was not an automatic reason to hold a new one.

Did the Deposit Guarantee Fund actually give up the fight for Ukrainians' money?

"StopCor has asked the DGF management to comment on the situation and voice its position on further actions to trace and possibly return (or not) the funds of Delta Bank depositors from abroad. We are currently waiting for an official response.

From the outside, the situation looks alarming: the war-torn state is losing a billion dollars, and officials don't care. Are there really those in the government who are interested in keeping the Yanukovych-era banker Mykola Lagun with his money and not having his foreign assets traced?

We will continue to closely monitor the developments. To be continued.

As a reminder, in October 2021, National Police investigators under the supervision of the Prosecutor General's Office served a notice of suspicion on the former owner of the bankrupt Delta Bank, who, together with four top managers, is suspected of embezzlement, misappropriation of funds and causing damage worth more than UAH 1 billion in this episode alone.

Read also:

Daily Horoscope: What the Stars Predict for All Zodiac Signs

Which Zodiac Signs Have the Strongest Immunity? An Astrological Health Analysis

Lithuanian Athlete Disqualified for Protest Shirt: Global Sports Reaction

Battalion "Achilles" Demonstrates Its Capabilities to a U.S. Delegation

How can you support Ukraine?

How can you support Ukraine?